(Reuters) -Mattel lowered its full-year sales forecast on Wednesday as the Barbie parent heads into the crucial holiday shopping season against the backdrop of muted demand for toys.

Shares of the company were up nearly 2% in extended trading as its cost-saving efforts boosted its margins.

Mattel (NASDAQ:MAT) raised its annual adjusted gross margin expectation to 50% from a prior range of 48.5% to 49%. Adjusted gross margin increased 210 basis points to 53.1% in the third quarter.

The Hot Wheels parent has turned to aggressive cost controls to ride out sluggish demand. It has set a target of $200 million in savings by 2026 through efforts such as streamlining its supply chain and exiting or out-licensing underperforming products.

The company raised its full-year cost savings target to about $75 million after achieving the earlier goal of $60 million within the first nine months.

It now expects 2024 net sales to be in the range of flat to down slightly from last year’s $5.44 billion, compared with its prior estimate of flat on a constant currency basis.

A shorter holiday season, with five fewer days between Thanksgiving and Christmas, has prompted retailers including Walmart (NYSE:WMT) and Target to roll out early deals on toys with low price points.

Net sales fell for the third straight quarter in the July-September period, declining 4% to $1.84 billion. Analysts on average had expected a 3.2% decline to $1.86 billion, according to data compiled by LSEG.

Worldwide gross billings for its Dolls category slumped 14%.

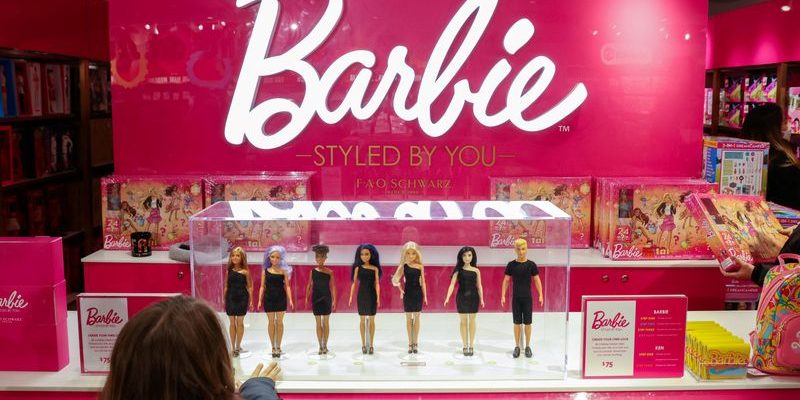

The “Barbie” movie release last year had boosted demand for Barbie-themed toys and other products, but the buzz has since eased.

Mattel, which is focusing on intellectual property partnerships for its popular brands such as Disney Princess and Despicable Me, maintained its annual forecast for adjusted earnings in the range of $1.35 to $1.45 per share.

On an adjusted basis, it earned $1.14 per share for the three months ended Sept. 30, beating estimates of 95 cents.