By Ankur Banerjee

SINGAPORE (Reuters) – Asian stocks eased on Tuesday in cautious end-of-year trading that has seen investors scale back bets of deep U.S. rate cuts in 2025 and brace for the incoming Trump administration, with the dollar standing tall against most other currencies.

Volumes were light with a holiday for the New Year looming and Japan on holiday for the rest of the week, with the Santa-rally losing some steam as elevated Treasury yields weigh on high equity valuations and boost the greenback.

MSCI’s broadest index of Asia-Pacific shares outside Japan nudged down 0.2% but was set for an 8% gain in 2024, its second straight year in the black.

China’s blue-chip CSI300 index was flat while Hong Kong’s Hang Seng index was 0.3% higher in early trading.

Data earlier in the day showed China’s manufacturing activity expanded for a third straight month in December but at a slower pace, suggesting a blitz of fresh stimulus is helping to support the world’s second-largest economy.

On Wall Street, all three major U.S. indexes closed on Monday with sharp losses in a broad selloff at the end of a strong year mainly due to end-of-year tax positioning, valuations worries and uncertainties about 2025.

Kyle Rodda, senior financial market analyst at Capital.com., said the principle issue for the markets right now is the risk of a “re-rating in bond markets, due to persistent inflation in the U.S. and the impacts of Trump tax-cuts and tariffs.”

Despite the year-end weakness, U.S. stocks have surged this year, with the Nasdaq on track for about a 30% annual gain and the S&P 500SPX> headed for more than a 24% rise.

The gloomy year-end mood is set to continue in Europe, with Eurostoxx 50 futures down 0.67%, German DAX futures down 0.62% and FTSE futures 0.08% lower.

Investor focus next year will be on the Federal Reserve’s rate path after the central bank earlier this month projected just two rate cuts, down from four in September due to stubbornly high inflation.

Cash Treasuries were untraded due to the holiday in Japan, while Treasury futures were little moved. Ten-year yields stood at 4.54% on Monday, having gained nearly 69 basis points this year.

Markets are also gearing up for President-elect Donald Trump’s policies around looser regulation, tax cuts, tariff hikes and tighter immigration that are expected to be both pro-growth and inflationary, keeping U.S. yields elevated.

“The market’s response to these policies will play a crucial role in deciding whether stocks will continue to gain into the first quarter of 2025 or if they lead to a cooling-off period/correction,” said Tony Sycamore, market analyst at IG.

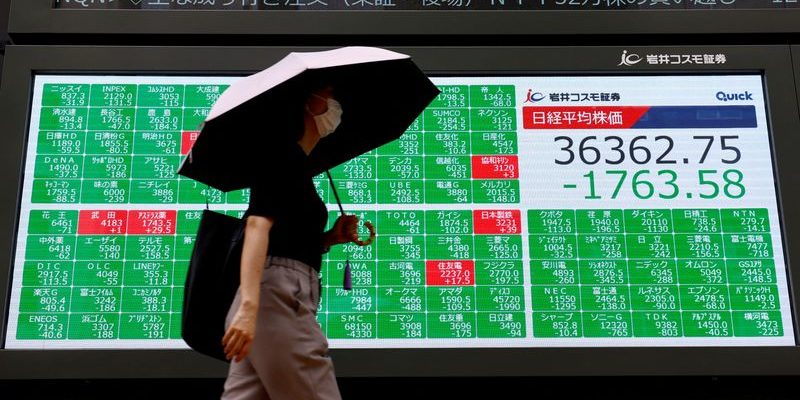

In Asia, Taiwan’s tech-heavy index soared 28% this year, its strongest annual performance since 2009. Japan’s Nikkei rallied 19% for the year, while Hong Kong’s Hang Seng rose 18%.

Pakistan’s benchmark share index surged 85% in the year, aided by improving investor sentiment around a fragile recovery in the South Asian economy after a $7-billion bailout was approved by the IMF in September.

South Korea’s KOSPI on the other hand was the worst performing stock market in Asia this year with a decline of 10% due to political turmoil.

The shifting expectations around U.S. rates and the widening interest rate difference between the United States and the other economies has lifted the dollar and weighed on other currencies.

The yen was a tad stronger on Tuesday at 156.435 per dollar but headed for an over 10% drop for the year, its fourth straight year of decline. The euro last fetched $1.041225, and is set for a nearly 6% drop in 2024.

The dollar index, which measures the U.S. currency against six other units, eased 0.1% to 107.95 but remained close to the two year high touched in November. The index is on course to rise 6.5% this year.

In commodities, oil prices were poised for a second straight year of decline on demand concerns in top consuming countries. For the year, Brent crude futures declined 3.2%, while U.S. West Texas Intermediate crude was down 0.6%/ [O/R]

But gold had a banner year, surging over 26% in the year, its strongest annual performance in over a decade on safe-haven demand amid geopolitical tensions around the world as well as monetary policy easing. [GOL/]